One of my 2024 New Year’s resolutions was to publish a blog post every month. Despite a few close calls – sometimes posting on the very last day of the month – I’m proud to say I achieved my goal! Thank you to everyone who has read anything I’ve written over the last year: I’m so grateful to all of you who have read my blog, provided feedback, read first drafts, engaged in debates on the future of NatSec tech, pitched me a startup idea, etc.

As any good blogger / venture capitalist must do at the end of the year, I decided to publish my list of predictions for the future of NatSec Tech in 2025. Overall, I predict that 2025 will be a great year for startups building for national security – I believe that the Department of Defense (DoD) will continue to accelerate its adoption of new innovative commercial technologies as it seeks to deter near peer adversaries in an increasingly unstable geopolitical world order. Further, there are tremendous opportunities for startups outside of defense as enterprises continue to accelerate their adoption of AI, robotics, cybersecurity, and other cutting edge technologies. However, I also predict that there will be a few bumps along the way for startups building in this space.

1. The DoD RDT&E budget for artificial intelligence (AI) in the FY 2026 POM will be more than $4B

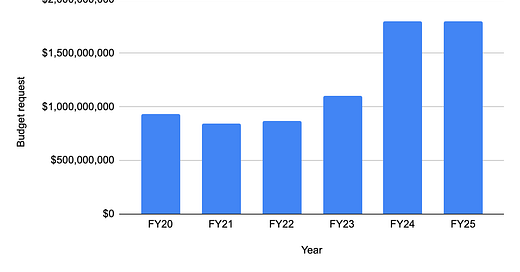

Over the past five years, the budget requested in the Program Objective Memorandum (POM) for AI-specific research, development, testing, and evaluation (RDT&E) has almost doubled. In FY25, the President’s budget requested $1.8B for AI-specific RDT&E, and undoubtedly more will be spent on other programs that incorporate AI like Maven.

I predict that several factors will spur the DoD to rapidly grow its AI budget. First, AI products are finally reaching maturity, making them suitable for deployment in large organizations such as the DoD. Underlying AI models continue to get better, as do the finetuning and orchestration technologies needed to improve AI application performance. Second, many AI products have now successfully navigated the rigorous, multi-year security certification processes required for deployment within the DoD. For instance, OpenAI’s models are now available on IL-4 and IL-5 environments, allowing them to securely handle Controlled Unclassified Information (CUI). Within the next year, OpenAI’s models will likely become available on more sensitive networks, particularly as OpenAI pursues more DoD business through its partnership with Anduril.

Third, as the Chinese military continues to advance the state of the art of AI technology and experiments with AI in its military, the US DoD will feel increased pressure to keep up. For instance, in November, Chinese research institutions linked to the People’s Liberation Army (PLA) released a military-focused AI tool that is able to gather and analyze intelligence and aid military decision making. The model was built on top of Meta’s open source Llama model and was fine-tuned and "optimised for dialogue and question-answering tasks in the military field.”

Fourth, politics aside, the new administration has the potential to appoint DoD leaders who deeply understand technology, AI, and startups. Obviously Trump advisor Elon Musk has firsthand experience with AI’s transformative power through his work at Tesla, xAI, and his other ventures. He also has extensive startup experience navigating government regulations and selling to DoD through his leadership at SpaceX. Further, Trump plans to nominate Steve Feinberg, the founder and CEO of Cerberus Capital Management, an alternative investment firm which invests heavily in national security-related technology, to be the Deputy Secretary of Defense (notably, reporting suggested that Trae Stephens, one of the co-founders of Anduril, was also up for the job, further showing the focus on bringing technology and finance experts into DoD leadership).

Fifth, demand for AI-enabled products continues to grow within the DoD. In 2024, several DoD services including the Marines and Space Force outlined their strategies for adopting AI. Similarly, in its first Defense Industrial Base strategy released in late 2023, the DoD underscores the significance of manufacturing automation and other cutting-edge technologies – including autonomous systems and AI – in strengthening the defense industrial base.

In just the last two months, DoD-focused AI activity seems to have accelerated. Foundation model providers OpenAI and Anthropic have both announced new efforts to sell into the DoD, partnering with the likes of Anduril and Palantir, respectively. Scale AI also announced its new DoD-focused AI product built on top of Meta’s LLaMA models. Additionally, the DoD’s Chief Digital and AI Office (CDAO) launched its new AI Rapid Capabilities Cell (AI RCC) in partnership with the Defense Innovation Unit (DIU) to accelerate and scale the deployment of cutting-edge AI in the DoD. “Through the AI RCC, CDAO and DIU will leverage $100M in FY 2024 and FY 2025 [including $40M in SBIR awards] to develop GenAI-focused pilots, a sandbox for pilot development, and user-centric experimentation through the following investments.”

2. DoD will double spending on VC backed startups in 2025

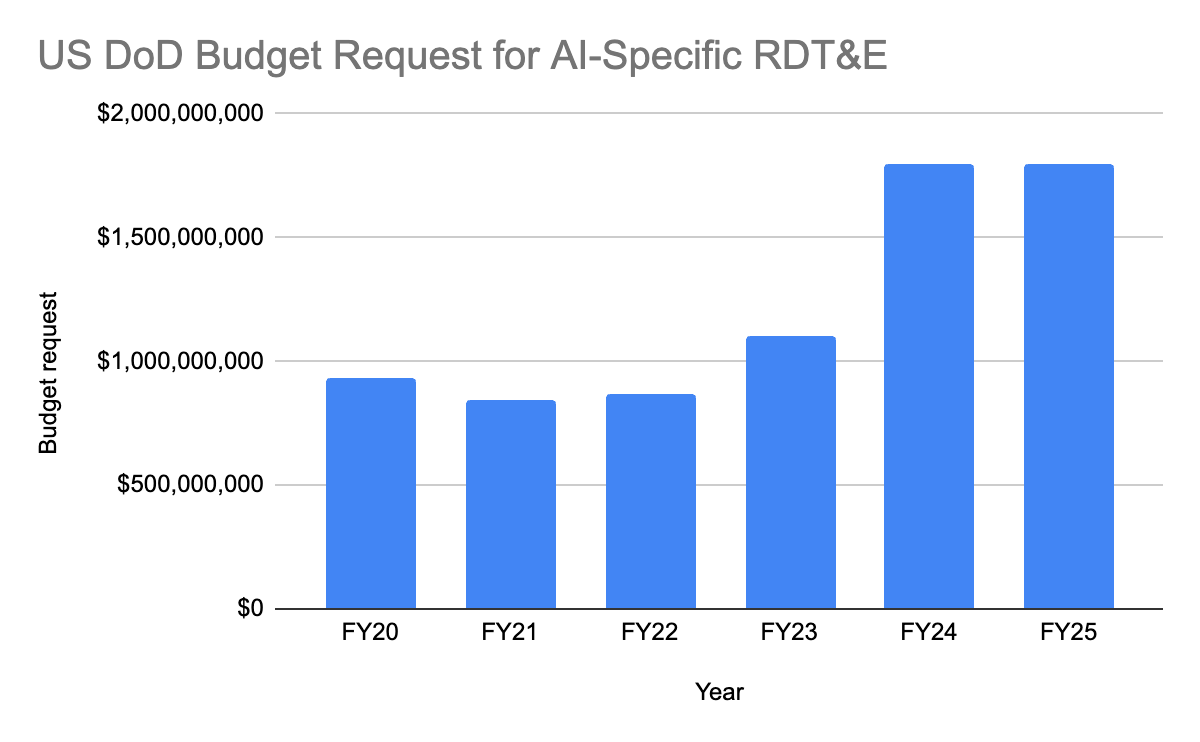

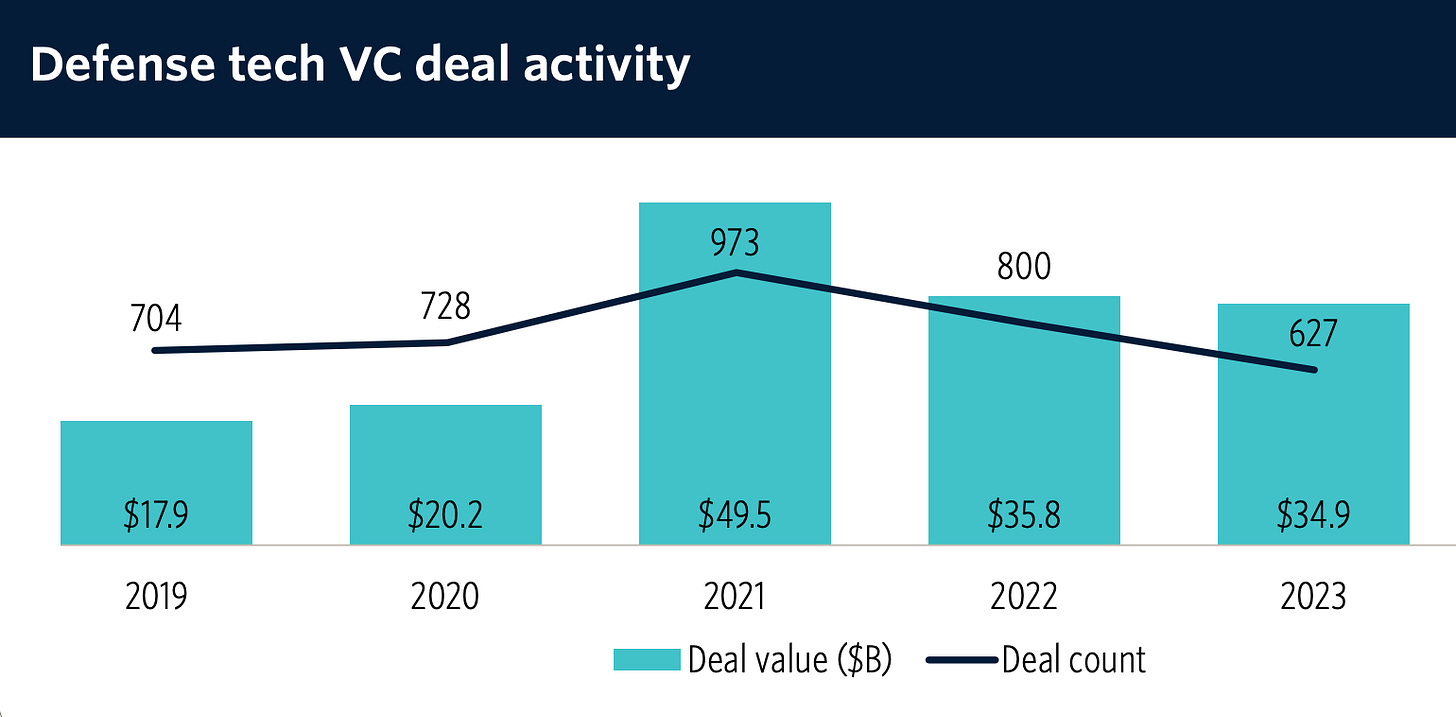

Despite investor enthusiasm for startups serving national security needs, the DoD has been slow to acquire technology from VC-backed companies. According to the Wall Street Journal, while investors have invested more than $100B in defense-focused startups since 2021, VC-backed startups win less than 1% of the DoD’s $411B awarded in contracts (~$4B). I predict that in 2025, DoD spending on VC-backed companies will more than double to $10B+.

Several factors will drive this increase. First, many defense-focused startups have matured over the past several years and are now ready for prime time with DoD customers – having refined their products, secured necessary security certifications, and expanded their federal sales teams. VC-backed startups like Anduril are competing head-to-head with traditional defense primes for large, multi-year programs of record like the US Air Force’s Collaborative Combat Aircraft (CCA) program. Second, as previously mentioned, the new administration is on track to appoint several DoD leaders who deeply understand VC-backed startups and the value they can provide to the DoD.

Source: “Investors Are Betting on Defense Startups. The Pentagon Isn’t,” Wall Street Journal.

3. The DoD will announce its first program of record focused on FPV drones

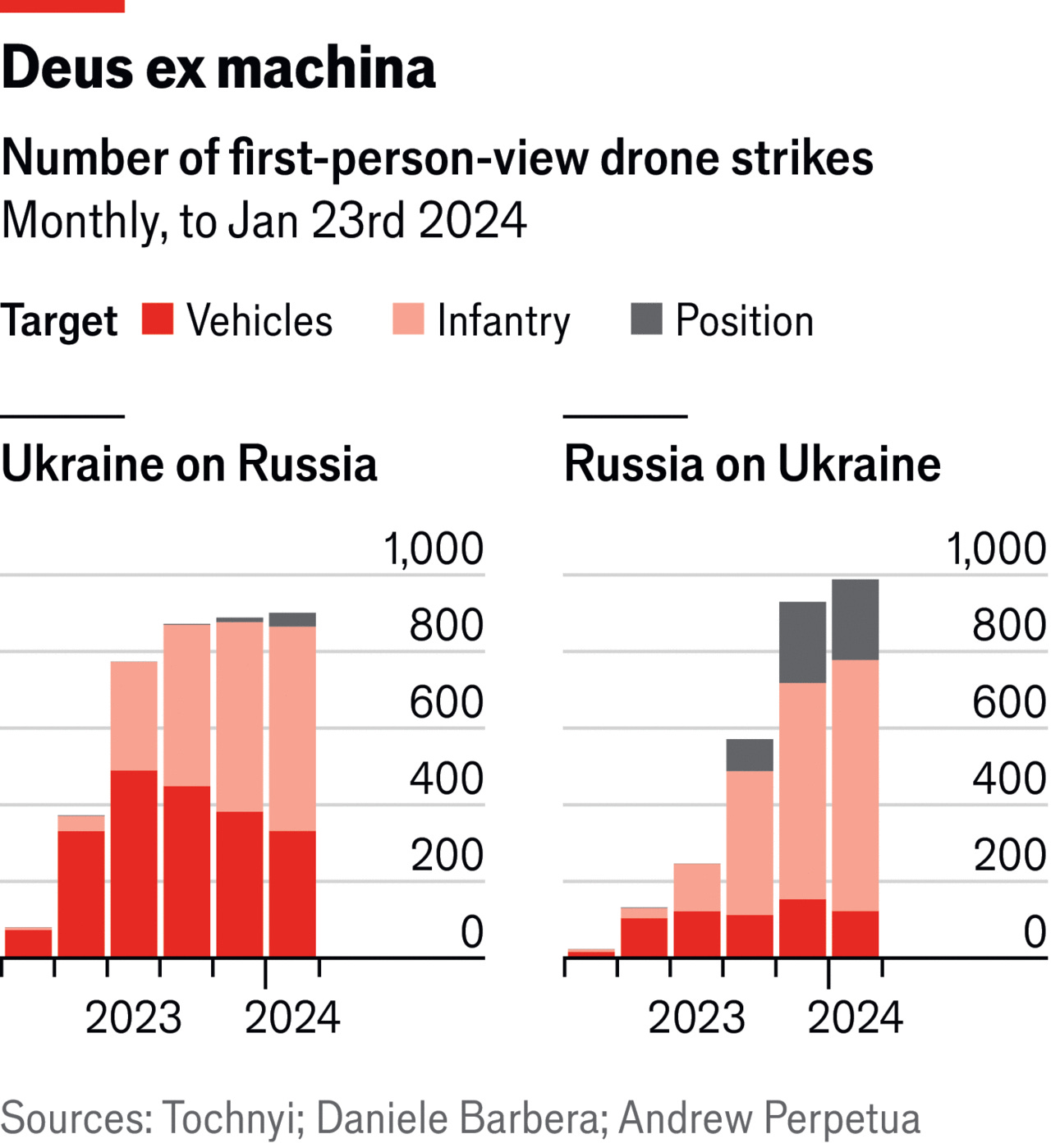

The war in Ukraine has showcased the power of deploying first person view (FPV) drones1 on the battlefield. Both Russia and Ukraine have made extensive use of FPV drones for both kinetic and ISR purposes. Recent conflicts in the Middle East have also seen extensive drone use – Israel, Hamas, and the Houthis have all deployed small drones over the past year.

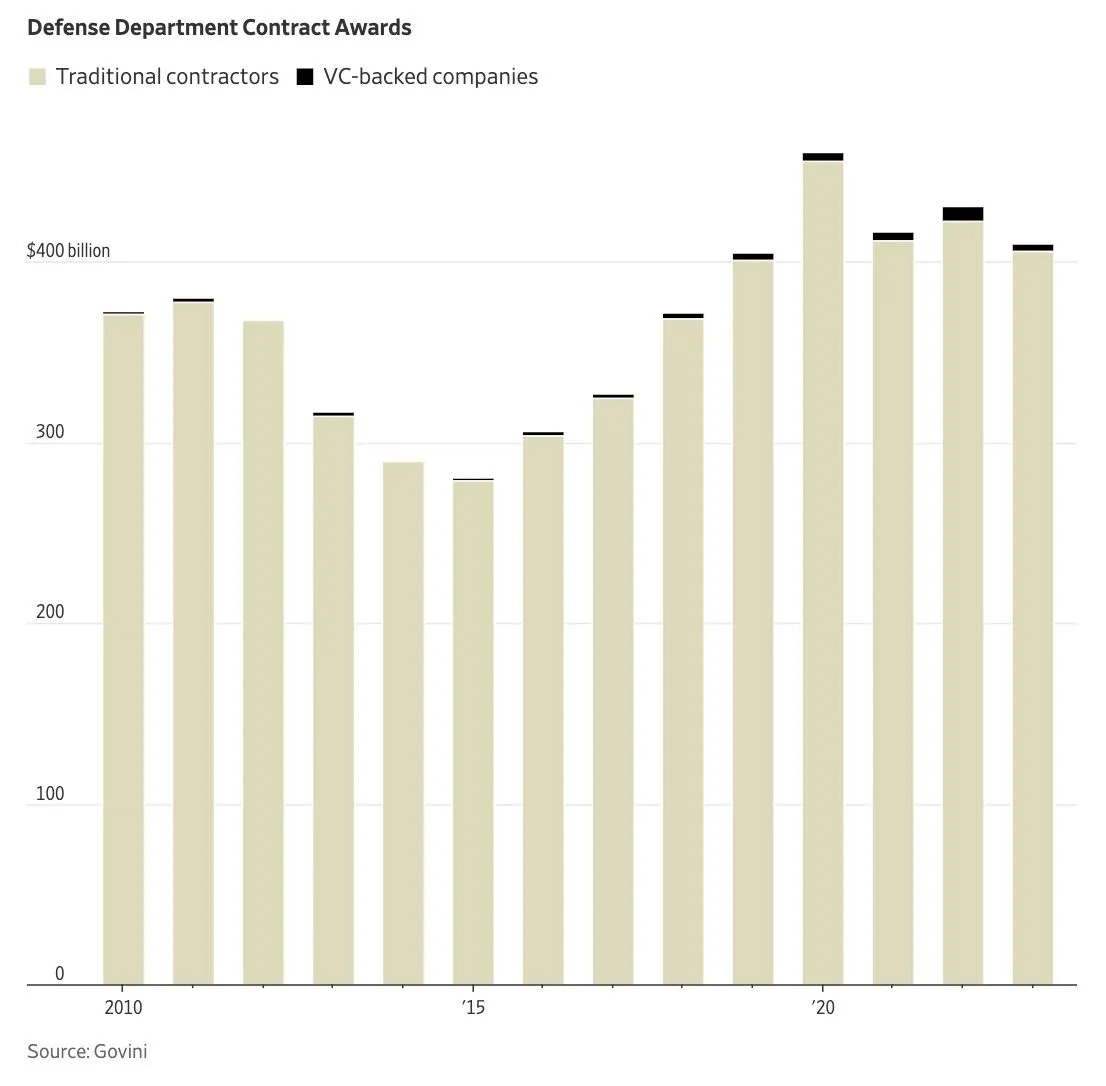

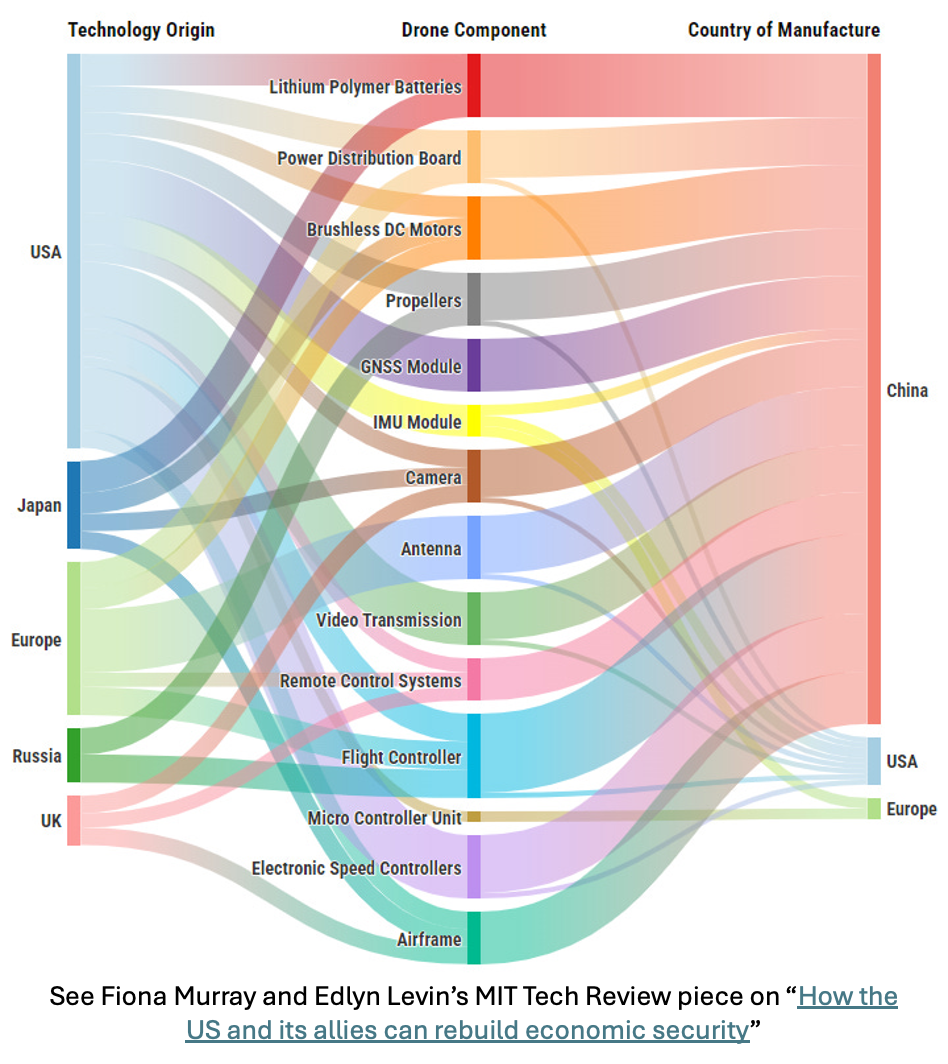

Chinese company DJI dominates the FPV market, with ~70% global drone market share,2 and even non-Chinese FPV drone makers rely on Chinese components (particularly for components like batteries).

Over the past several years, the DoD’s UAV acquisition efforts have largely centered on Replicator, focusing primarily on larger drones such as AeroVironment Inc.’s Switchblade-600 loitering munition and on maritime systems. However, recently DoD officials indicated plans to establish a program of record centered on smaller FPV drones in FY25, with the goal of fielding them by FY26. I predict that the DoD will announce this program of record before July 2025, and that a venture-backed startup will secure the prime contract – though it’s highly unlikely to be awarded in 2025.

Source: “How cheap drones are transforming warfare in Ukraine,” The Economist.

4. The DoD will announce the launch of a new project focused on humanoid robots in collaboration with a VC-backed company

Thus far, the DoD’s experimentation with humanoid robots has been limited, confined to a handful of DoD research labs. Between 2012 and 2015, DARPA conducted research on humanoid robots as part of its robotics challenge, in which Boston Dynamic’s humanoid Atlas robot debuted. Similarly, in 2015 the Office of Naval Research unveiled its Shipboard Autonomous Firefighting Robot (SAFFiR), a humanoid robot designed to fight fires on naval vessels.

However, I predict that in the coming years, the DoD will increase its efforts to develop humanoid robots for national security use cases. In particular, the DoD will likely launch a new research initiative focused on humanoid robotics and will collaborate with a VC-backed company – or a consortium of companies – to drive the effort forward.

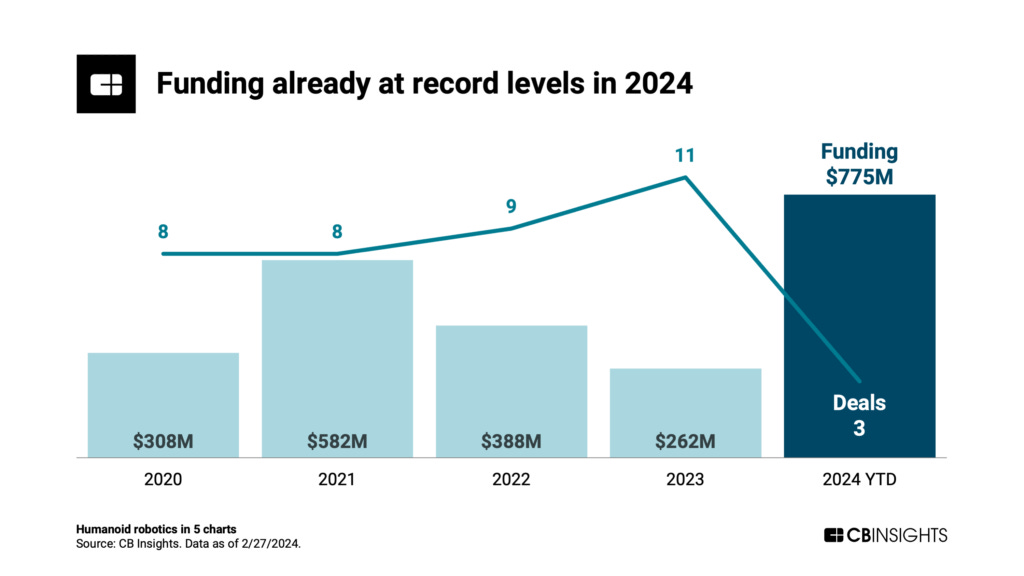

DoD interest in humanoid robotics will be driven by a handful of factors. First, humanoid robot technology has continued to mature over the last decade, particularly as more funding has emerged to push the state of the art forward. Investors poured close to $800M into humanoid robot startups like Figure and Agility Robotics in 2024, setting a record high. More established players like Boston Dynamics and Tesla also continue to push the state of the art in humanoid robotics with increasingly impressive demo videos of systems like Tesla’s Optimus robot.

Additionally, “robotics foundation model” companies have raised significant capital. Startups like Physical Intelligence and Skild promise to develop true, generalizable autonomy software that will work on a number of robot embodiments, including humanoid robots (in contrast to today’s more brittle, limited autonomy software which only works on specific hardware). As I’ve written about before, these robotics foundation models will lower the barrier to entry to deploy humanoid robots that provide real value.

Source: “Humanoid Robotics in 5 Charts,” CBInsights.

Second, the DoD will feel competitive pressure to explore use cases for humanoid robots as Chinese roboticists continue to advance Chinese humanoid technology. In 2024 Chinese robotics companies like Unitree released impressive demos highlighting Chinese advancements in humanoids. While experts believe that Chinese robotics technology still lags behind the US, Japan, and Germany, Chinese roboticists are rapidly closing the capability gap. Funding for humanoid robotics has seen a similar surge in China in recent years. Chinese humanoid robot firms raised $769 million (RMB 5.4 billion) in 2023 and another $997 million (RMB 7 billion) in the first half of 2024. Further, in July 2024, Shanghai announced a $1.4 billion fund to support its local humanoid robots industry.

I’m certainly not predicting that we will see humanoid robot soldiers any time soon. However, as humanoid robotic technology matures, there will certainly be use cases relevant to national security including in manufacturing, firefighting, healthcare, and logistics.

5. There will be major shakeups in valuations for some VC-backed NatSec startups: a) Two large NatSec startups will merge, b) one prominent NatSec startup will have a large down round, and c) three new NatSec “unicorns” will be minted.

Since 2019, VC firms have invested more than $100B into startups building technologies for national security. 2024 saw several more large fundraising rounds for NatSec startups – for example, in August Anduril raised a $1.5B Series F round at a $14B valuation. Further, as of early December, Palantir’s market cap officially exceeds that of RTX, previously the largest defense company by market cap, and SpaceX is considering a tender offer that would value it at $350B – up from its $210B valuation from after an earlier tender offer in June.

Source: Pitchbook, “Vertical Snapshot: Defense Tech Update”

These high valuations and investor activity reflect investors’ optimism that the DoD will continue to increase its adoption of technology developed by VC-backed startups. Certainly as geopolitical tensions continue to rise and the US gets closer to a potential conflict with a technologically sophisticated near-peer adversary, the DoD must continue to find ways to adopt innovative technologies that help warfighters. There is no doubt that in the coming years many startups will break through and land large DoD contracts to deliver essential technology. As such, I predict that there will be at least three new NatSec “unicorns” minted in 2025 – that is, at least three national security focused startups will raise fundraising rounds valuing them at $1B or more.

Although there’s much to be optimistic about for startups selling to national security in 2025, they will still face significant headwinds when entering the defense market. I predict that several NatSec startups will struggle to grow into their inflated valuations, finding it difficult to grow DoD revenue fast enough to secure another round of funding. As a result, I predict that in 2025 at least one high-profile NatSec startup will be forced to raise a “down round,” or accept a discounted acquisition, in order to stay afloat.

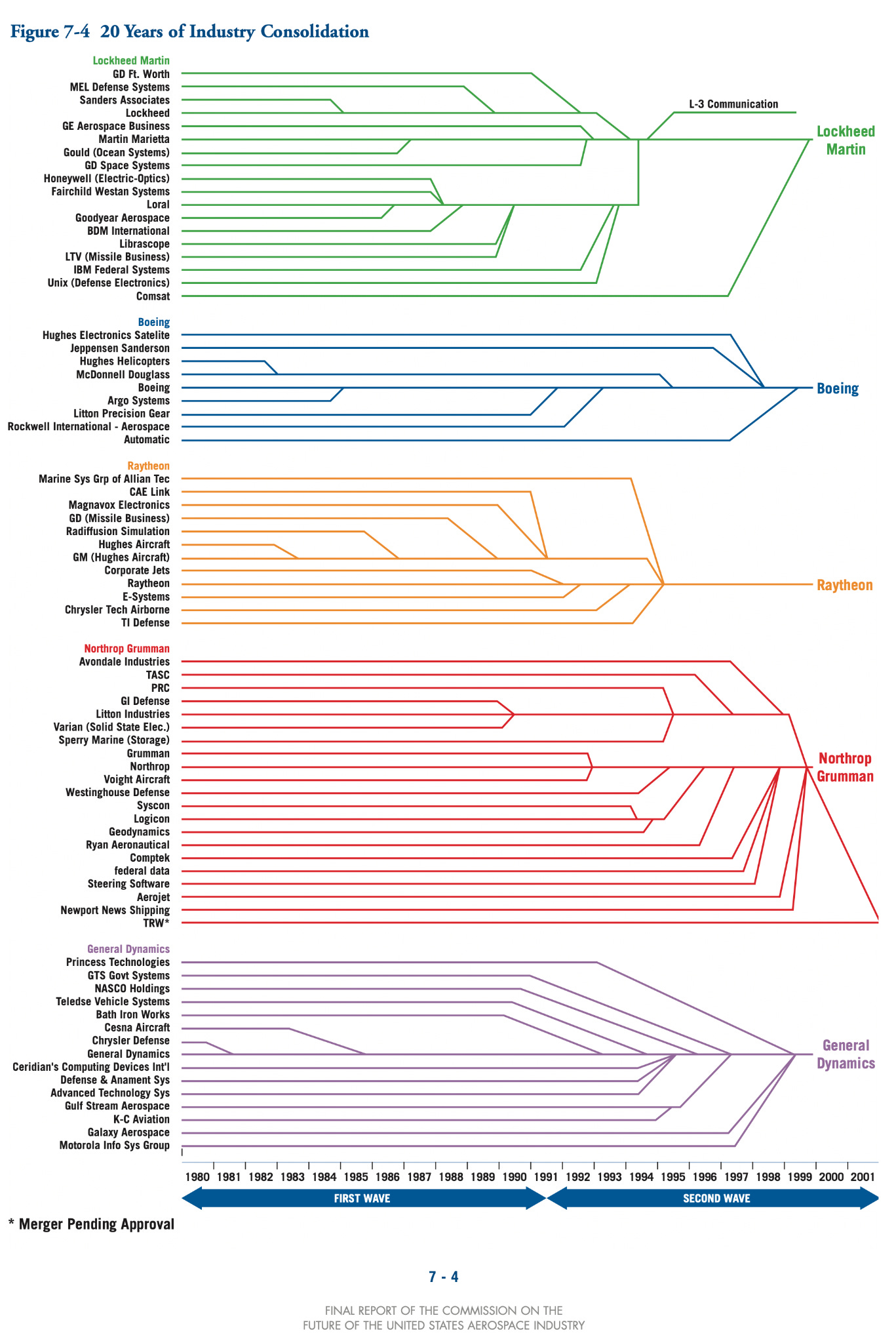

Similarly, I predict that two prominent NatSec startups will merge in 2025. As I’ve written about in the past, the DoD is a tricky customer, and some startups will be able to benefit by combining forces in order to more effectively win DoD contracts. Existing startups focused on NatSec clearly already see the value of combining forces to win DoD contracts – earlier this month Palantir, Anduril, SpaceX, OpenAI, Saronic, and Scale AI announced that they are in talks to form a consortium that will jointly bid for U.S. government work in order to challenge to challenge the dominance of prime defense contractors like Lockheed Martin, RTX, and Boeing. It isn’t hard to imagine these kinds of startup consortia becoming more commonplace and potentially leading to a new wave of mergers. The defense industrial base is no stranger to mergers and acquisitions – today’s leading prime contractors arose from decades of M&A activity, often at the expense of genuine competition in the defense economy.

Source: “Final Report of the Commission on the Future of the United States Aerospace Industry.”

Finally, here are a few additional “rapid fire” predictions that I crowd sourced over the past month:

CDAO will have another rebrand

CJADC2 will get another new acronym

The Navy will announce plans to significantly increase its spending on unmanned systems

Hypersonics testing will occur weekly across multiple startups and primes

Proliferated constellations will begin to transfer to VLEO3 architecture

Talent Management will become significant reform priority for DoD

More non-VC private equity / private capital will enter the national security technology market as companies look for diversified capital

Deeper AUKUS4 tech development and tri-lateral funding for programs / policy alignment

Japan joins AUKUS in 2026 and AUKUS is renamed JAUKUS

Overall, I predict that 2025 will be a great year for startups building for national security. The DoD appears poised to adopt cutting edge technologies more rapidly and at a larger scale than ever before. The need for the DoD to adopt cutting edge technology has never been more urgent.

As always, please let me know your thoughts! Do you agree with my predictions? Anything important I missed?

And of course, please reach out if you or anyone you know is building at the intersection of national security and commercial technology.

Happy holidays and happy new year!

Note: The opinions and views expressed in this article are solely my own and do not reflect the views, policies, or position of my employer or any other organization or individual with which I am affiliated.

FPV drones are small, cheap, remote-operated copter-powered UAVs.

One Ukrainian military official suggested that Ukraine was buying as much as 60% of all DJI Mavic quadcopters.

VLEO = very low earth orbit

AUKUS = Australia, United Kingdom, United States