When you spend time with folks working at “hardtech” and “defense tech” startups (as I seem to do a lot these days…), it is common to hear phrases like “American manufacturing is dead” and “We need to revitalize American manufacturing.” These startups are working to manufacture all kinds of complex, critical systems in a secure and resilient way – Apex Space is manufacturing modular satellite buses, reducing the time needed to manufacture satellite buses by more than a year; Neros plans to fully vertically integrate the manufacturing of small attritable autonomous systems to compete against the likes of Chinese drone manufacturers like DJI; and Albedo Space is producing satellites that are capable of capturing images at a higher resolution (10cm) than any company on the market.

Undoubtedly, improving the efficiency, resiliency, and output of the American manufacturing base is crucial to national security, to traditional defense primes, and to the success and security of these startups’ endeavors. Earlier this year, the Department of Defense (DOD) released its first ever National Defense Industrial Strategy, which outlined the ways that the DOD can help strengthen America’s defense industrial base. The defense industrial base has contracted since the end of the Cold War as some commercial manufacturing and supply chains moved overseas and countries like China became powerhouses of industries like shipbuilding, critical minerals, and microelectronics. Indeed, the DOD has struggled to manage the security and resiliency of the defense industrial base. For instance, in 2019, it was revealed that Aventura Technologies, an equipment provider that sells cameras, among other products, to the US military, had lied about the origin of its equipment – while Aventura’s cameras were packaged in boxes labeled “Made in the U.S.A”, the cameras had in fact been developed in China, which opened up the potential for the technology to have been tampered with for espionage purposes. Similarly, in 2022, Lockheed Martin discovered that some of the magnets used in the F-35 were acquired from Chinese sources.

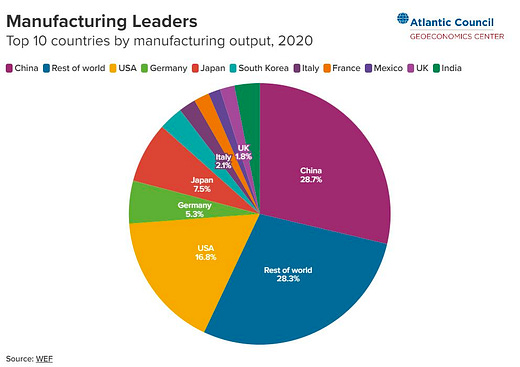

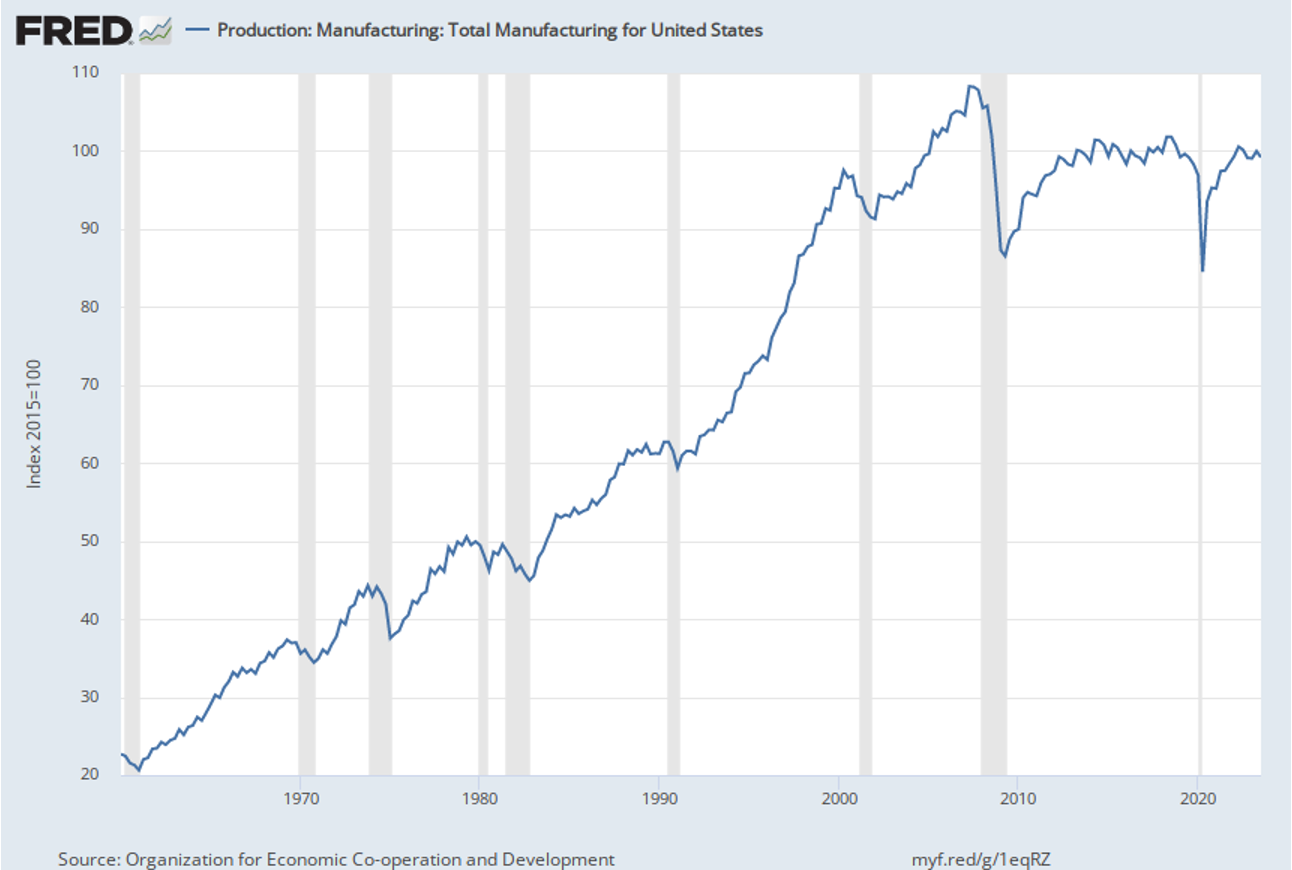

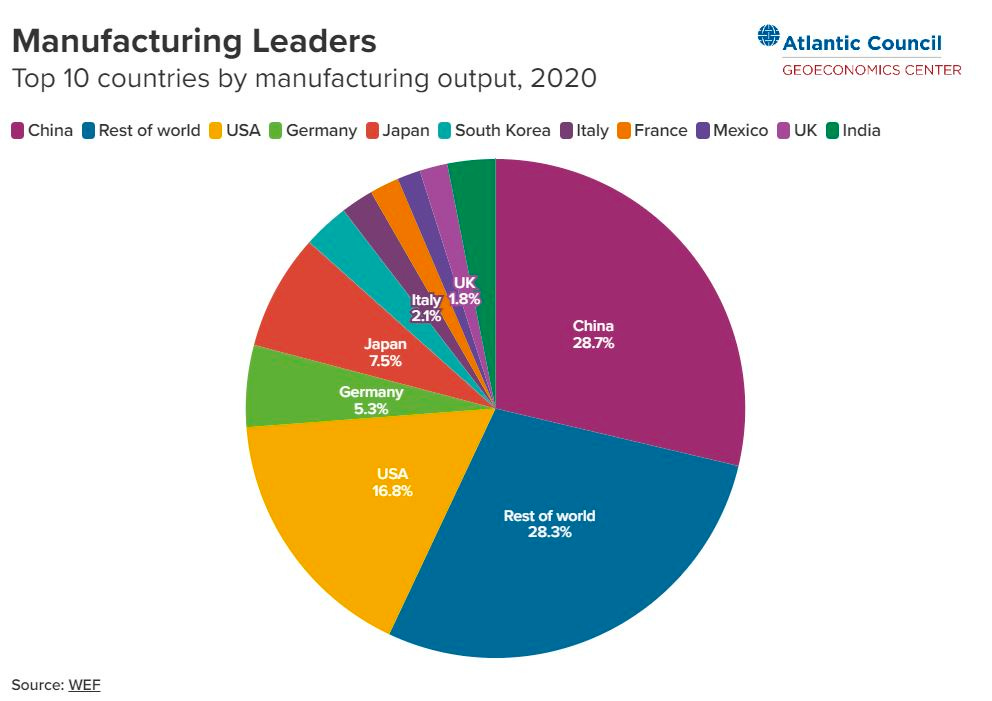

However, in order to understand how to improve American manufacturing, it’s important to understand the state of American manufacturing today. Despite what some might claim, it’s not wholly fair to declare American manufacturing “dead.” Today, contrary to popular belief, the US manufactures much more than what it manufactured in the Cold War era and continues to be the second largest manufacturer in the world (second only to China).

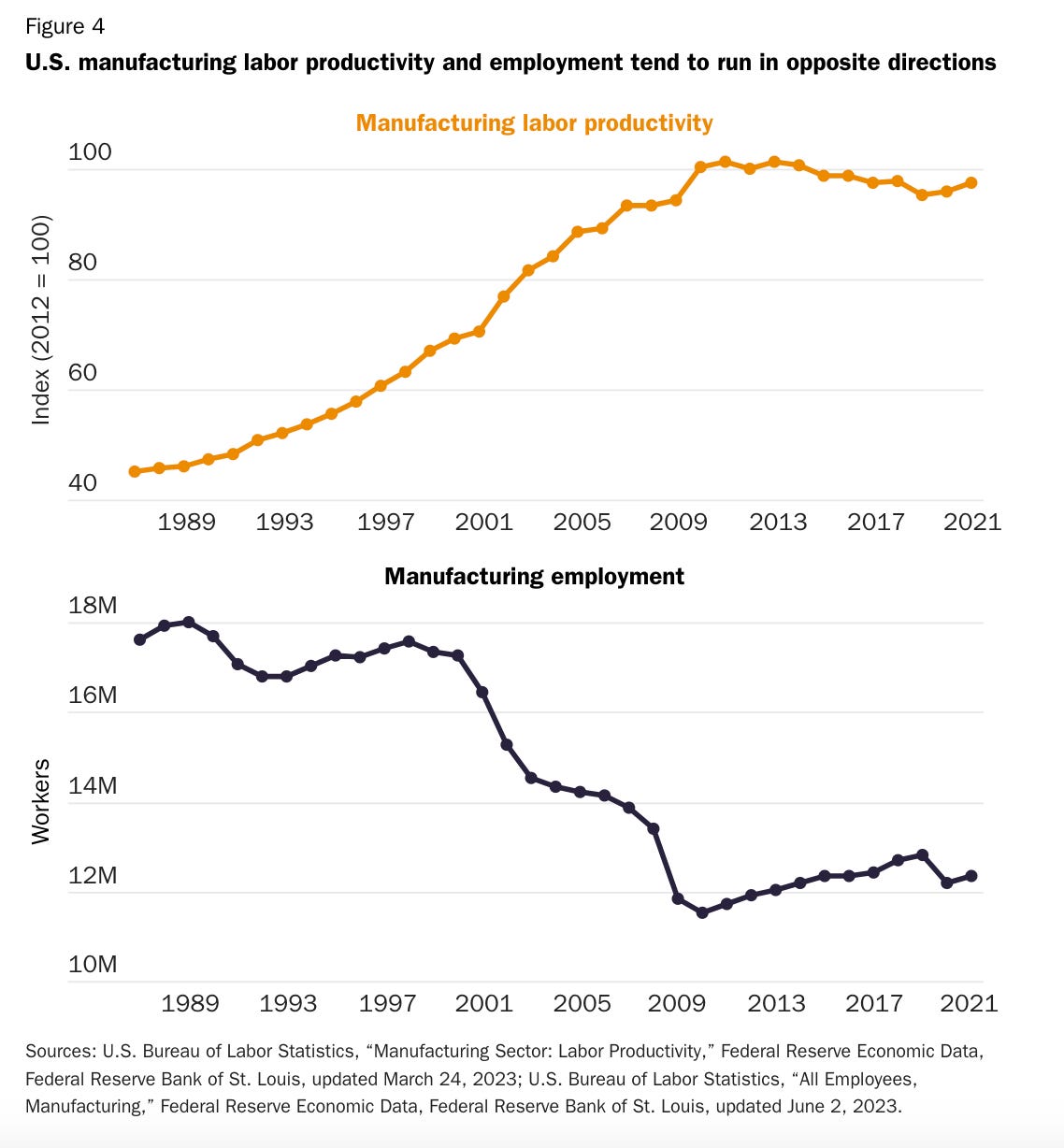

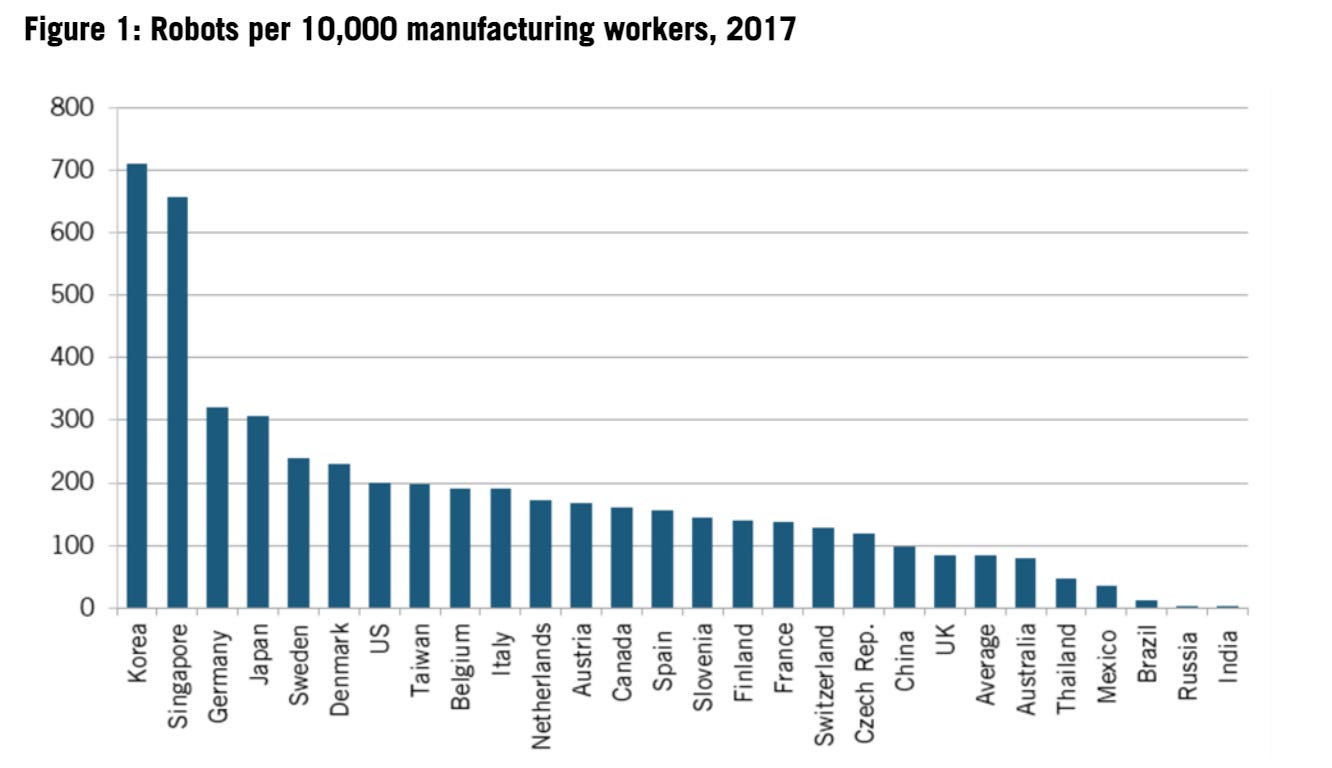

So why is there such a prevalent belief that the US no longer manufactures the way it used to? First, much of US manufacturing increase has been driven by increased productivity due to automation and robotics. So, while US manufacturing has greatly increased, US manufacturing employment has drastically decreased over the past several decades. Many fewer people today in the US actually work in manufacturing, making it a much less visible industry to the average American.

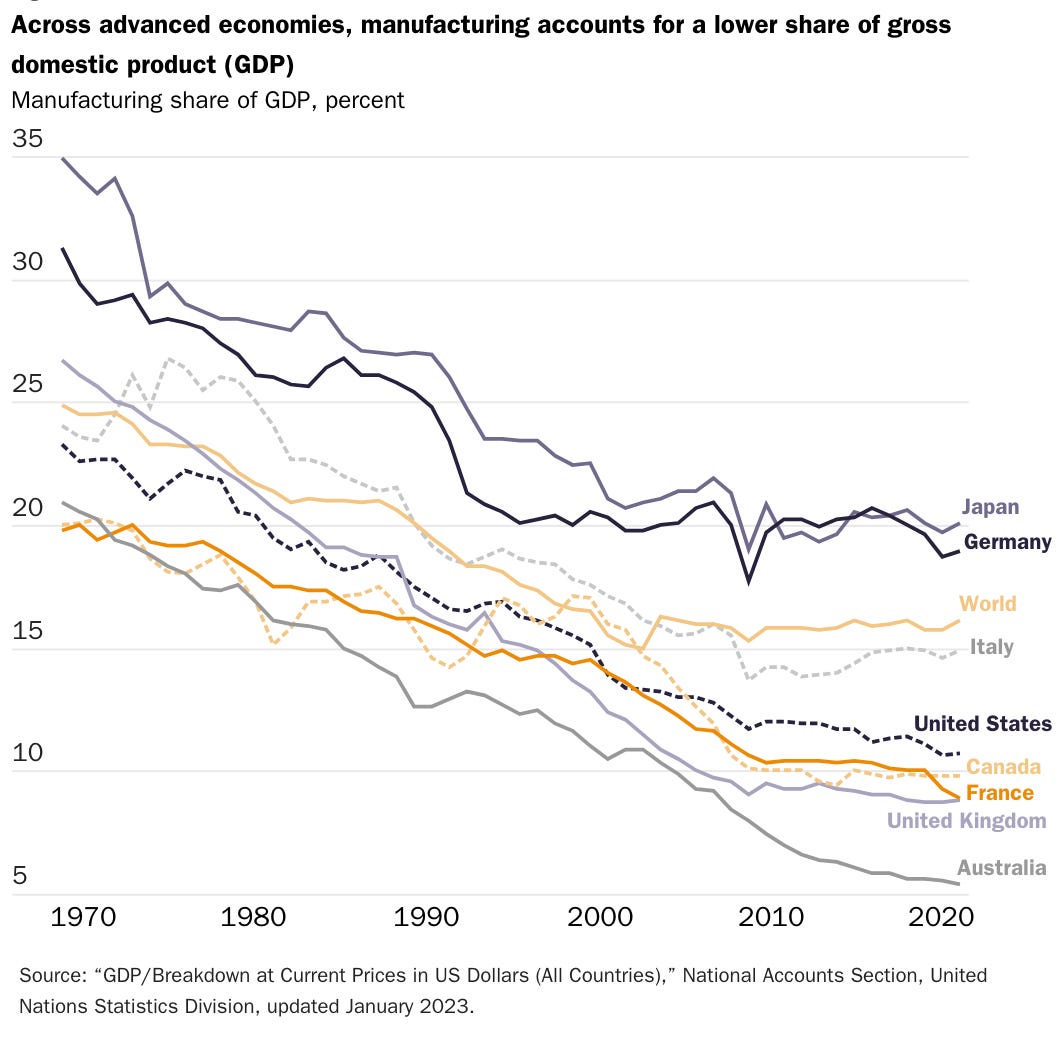

Second, manufacturing is a much smaller share of the US’s GDP today than in the past. However, this trend is not exclusive to the US – today, manufacturing is a much smaller share of the whole world’s GDP than it once was, in part because services’ share of global GDP has grown.

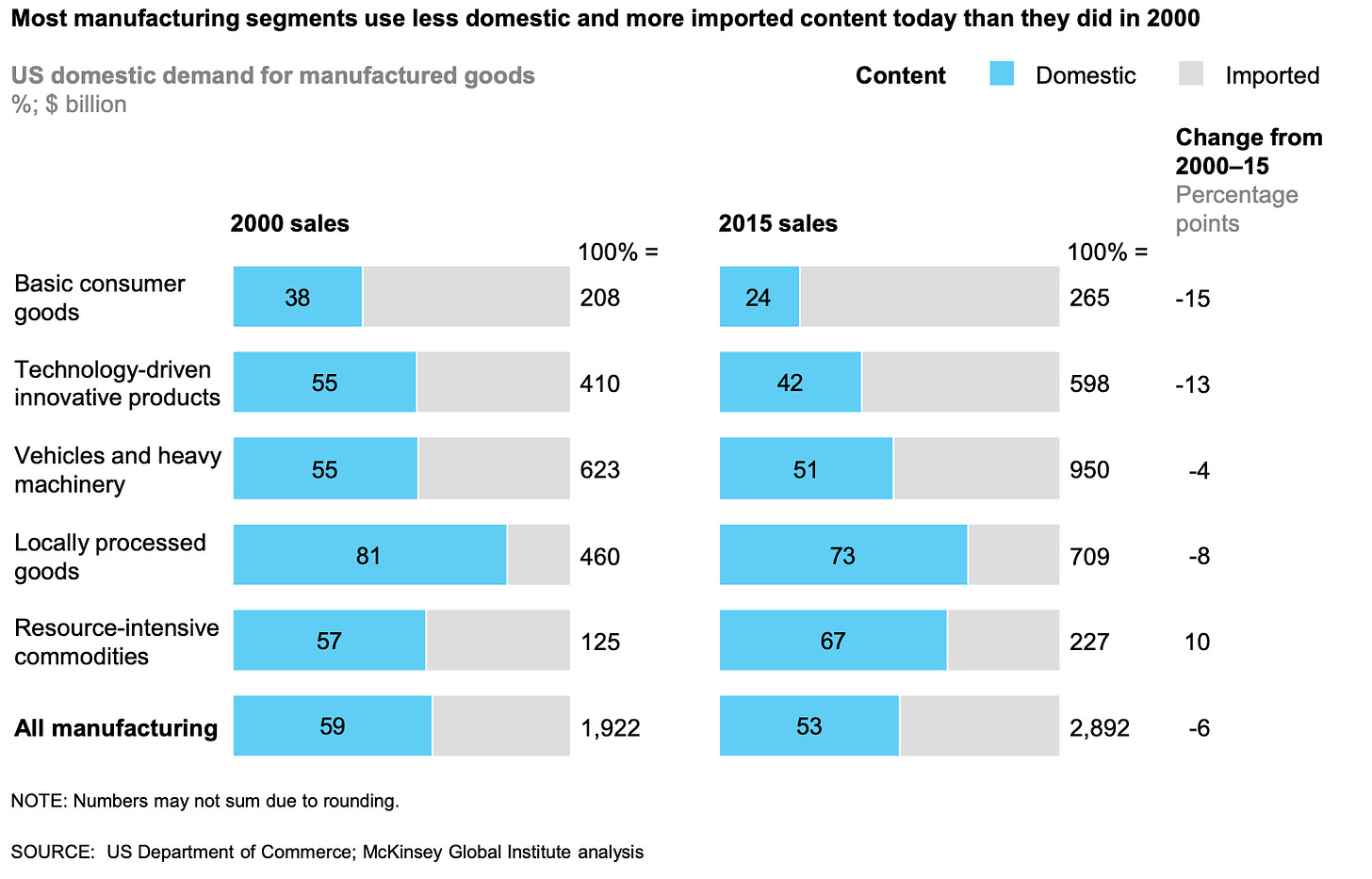

Third, while the US is still the second largest manufacturer in the world, the US controls a much smaller share of overall manufacturing than it used to. As transportation and communication technology improved in the mid 20th century, it made economic sense for many manufacturing processes to move overseas for various reasons including differences in regulatory regimes, reduced wages overseas, and foreign government initiatives to lure manufacturers. As a result, today, more US products rely on parts developed overseas than in the past.

Moving manufacturing processes overseas in and of itself is not necessarily a bad thing – in fact, it provides many benefits such as decreasing costs of products for consumers and reducing redundancy in supply chains. Imagine, for example, how much more expensive computers would be if every country needed to independently develop, manufacture, and maintain extreme ultraviolet lithography machines. Globalization benefits everyone when relations between countries are positive and supplies are in abundance. However, with the shifting geopolitical landscape and escalating tensions between the US and countries such as Russia and China, monitoring supply chain security has become increasingly critical.

While the numbers show that the US clearly remains a manufacturing powerhouse, the state of US manufacturing and the security of the US supply chain is far from perfect. First, while the US remains a leader in the manufacturing of products like medical devices and commercial aircraft, there are a number of critical materials, components, and finished products that the US is reliant on adversary countries for. Most notably, the US is highly reliant on China for materials like active pharmaceutical ingredients and rare earth elements; components like batteries, permanent magnets, printed circuit boards (PCBs), and castings & forgings; and products like mobile phones, computers, air conditioners, solar panels, TV sets, ships, refrigerators, and automobiles. Additionally, a significant portion (38%) of semiconductor assembly, packaging, and testing (the final stage in the semiconductor production process) is conducted in China, and the majority of the world’s advanced semiconductors are manufactured in Taiwan, which is at high risk of Chinese invasion. Since Russia’s invasion of Ukraine, the US has also found itself pressed for materials like silicon and pig iron, both of which are crucial to the castings and forgings industry (note that “castings form key parts of roughly 90% of all durable goods, from automobiles and ships to aerospace and defense equipment”).

While some of these supply chain reliances are inevitable (for instance, the processing of some critical materials like lithium is incredibly unfriendly to the environment, making those materials impossible to process in the US due to environmental regulations), many are the result of purposeful state-sponsored initiatives to insert themselves into critical supply chains. For instance, the Chinese government heavily subsidized domestic mining and refining of rare earth elements (which “are not actually rare but rather are rarely found in isolation, are costly to separate, and are costlier to refine”). Rare earth elements are critical to national security-related products such as aircraft engines, fiber optic cables, TV and computer displays, electric vehicle motors, and medical devices.1 Similarly, the Taiwanese government engaged in industrial policy to incentivize the development of its domestic semiconductor industry, upon which the world is now highly reliant.2

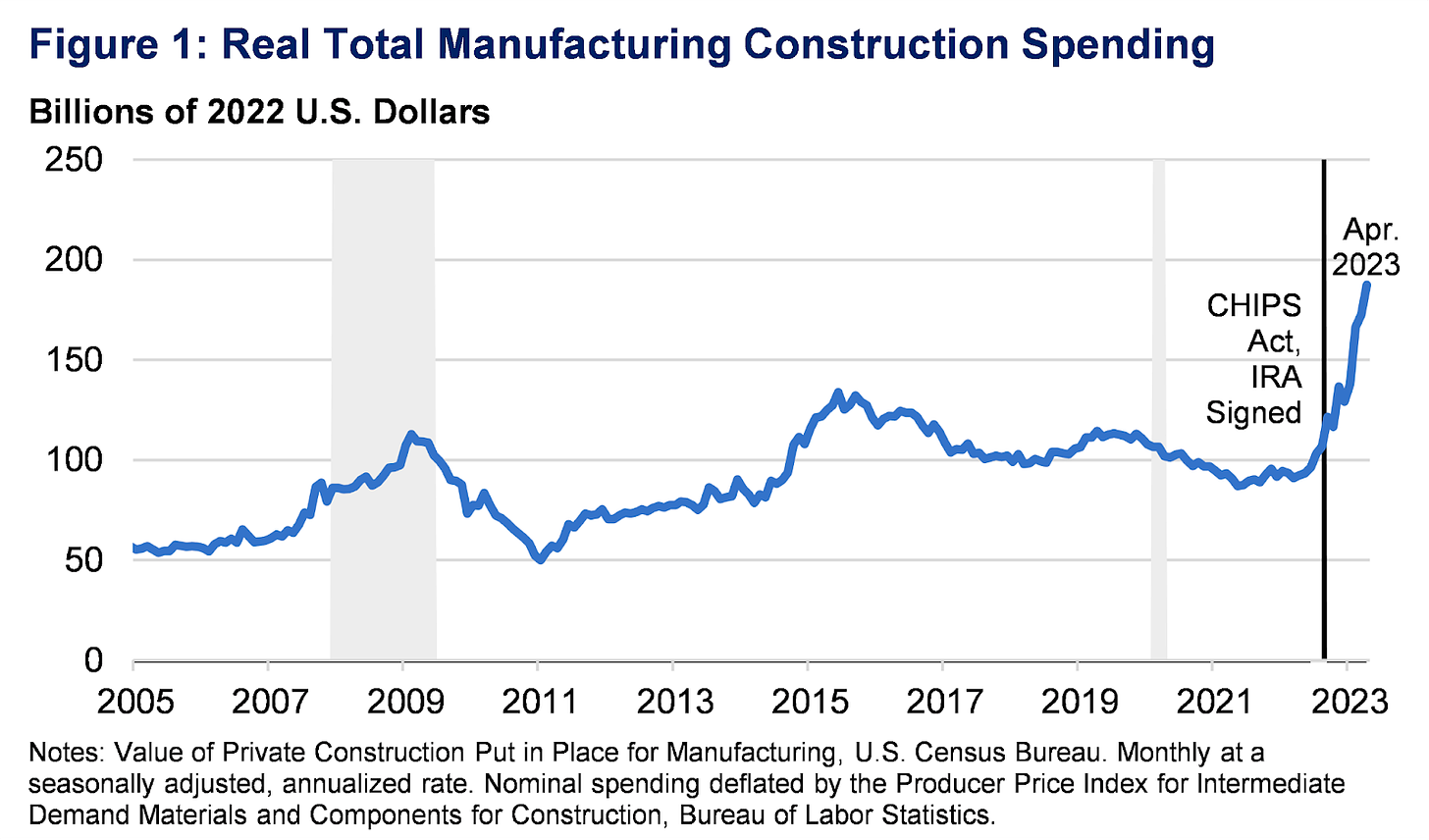

While the US has engaged in some industrial policy in recent years (most notably via the CHIPS Act and Inflation Reduction Act), it is unlikely the US government will engage in the kind of industrial policy that countries like China and Taiwan have engaged in the mid to late twentieth century. That being said, recent policy moves have already started to drive spending on activities critical to improving the state of American manufacturing (ex: construction of manufacturing facilities).

Rather than rely on US government spending to subsidize American manufacturing, US manufacturers and hardware developers will need to continue to rely on technology to improve manufacturing efficiency, resiliency, and security.

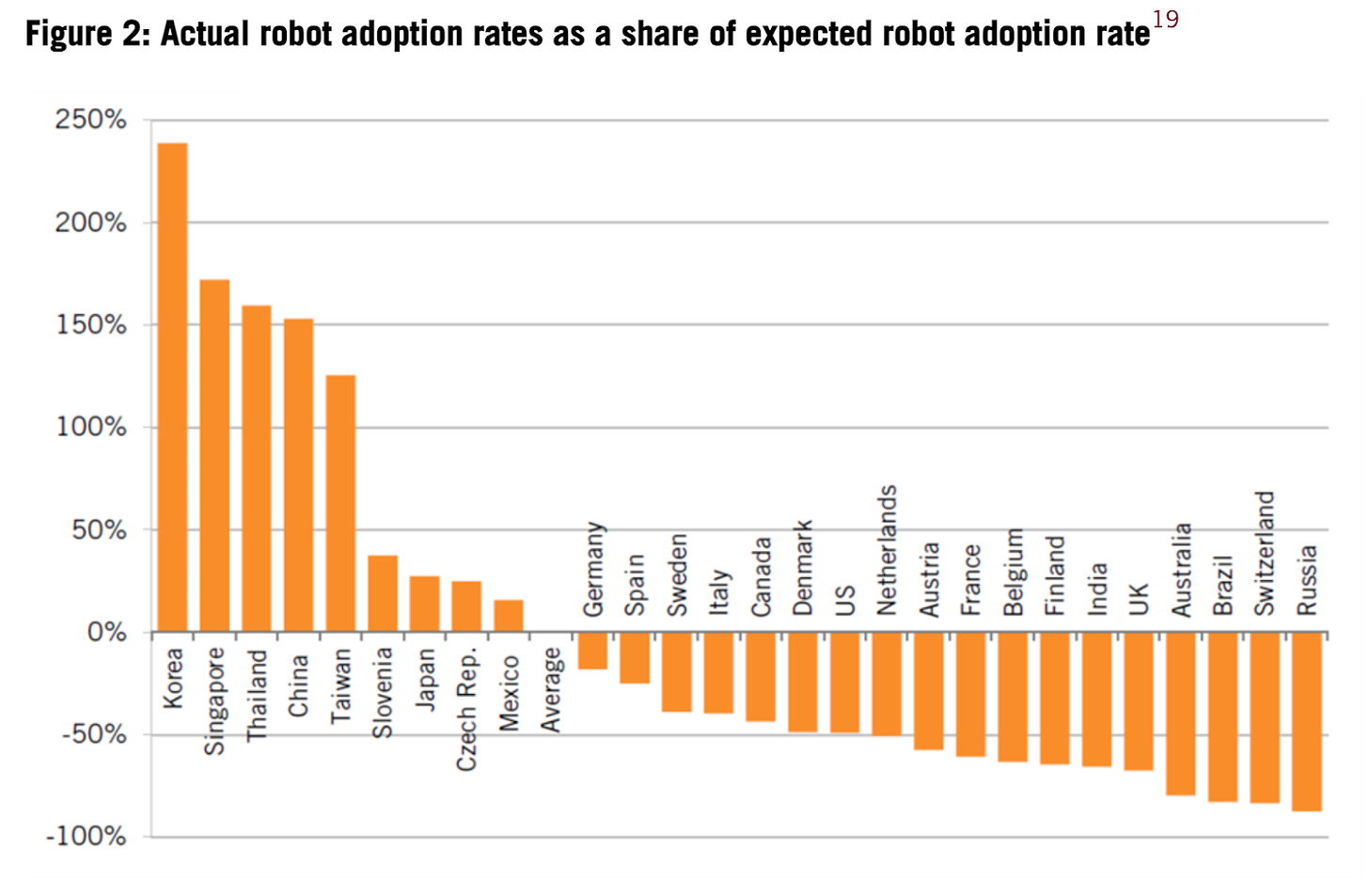

While digging into the state of US manufacturing, something that surprised me was the US’s relative lack of robotics automation compared to other countries. Despite having a relatively high cost of manufacturing labor and highly technical workforce, the US is only 7th in terms of robotics adoption for manufacturing, less than would be expected based on US wages. To be fair, once again, many of the leading adopters of robotics for manufacturing are countries in which governments have economically incentivized robotics adoption. Nevertheless, as the cost of robotics has continued to decline while the quality has greatly increased, robotics adoption represents an exciting area of opportunity to improve US-based manufacturing.

Over the past few years a number of companies have emerged to help improve manufacturing automation in the US. Some moonshot companies like Apptronik and Figure are focused on developing humanoid robots that will be able to automate general purpose manufacturing. Other companies are specifically focused on introducing cutting-edge AI software to existing commodity hardware. For instance, companies like Jacobi Robotics, ThoughtForge, Gray Matter Robotics, and Covariant AI are helping OEMs deploy cutting-edge computer vision software to commodity hardware like robot arms for manufacturing and warehouse use cases. Deploying cutting edge AI to commodity hardware will enable robots to conduct more generalized tasks (as opposed to robotics deployed in manufacturing today which tend to be very good at only one or two discrete tasks). Still other companies like Bright Machines are focused on developing vertically integrated software and hardware systems for manufacturing automation.

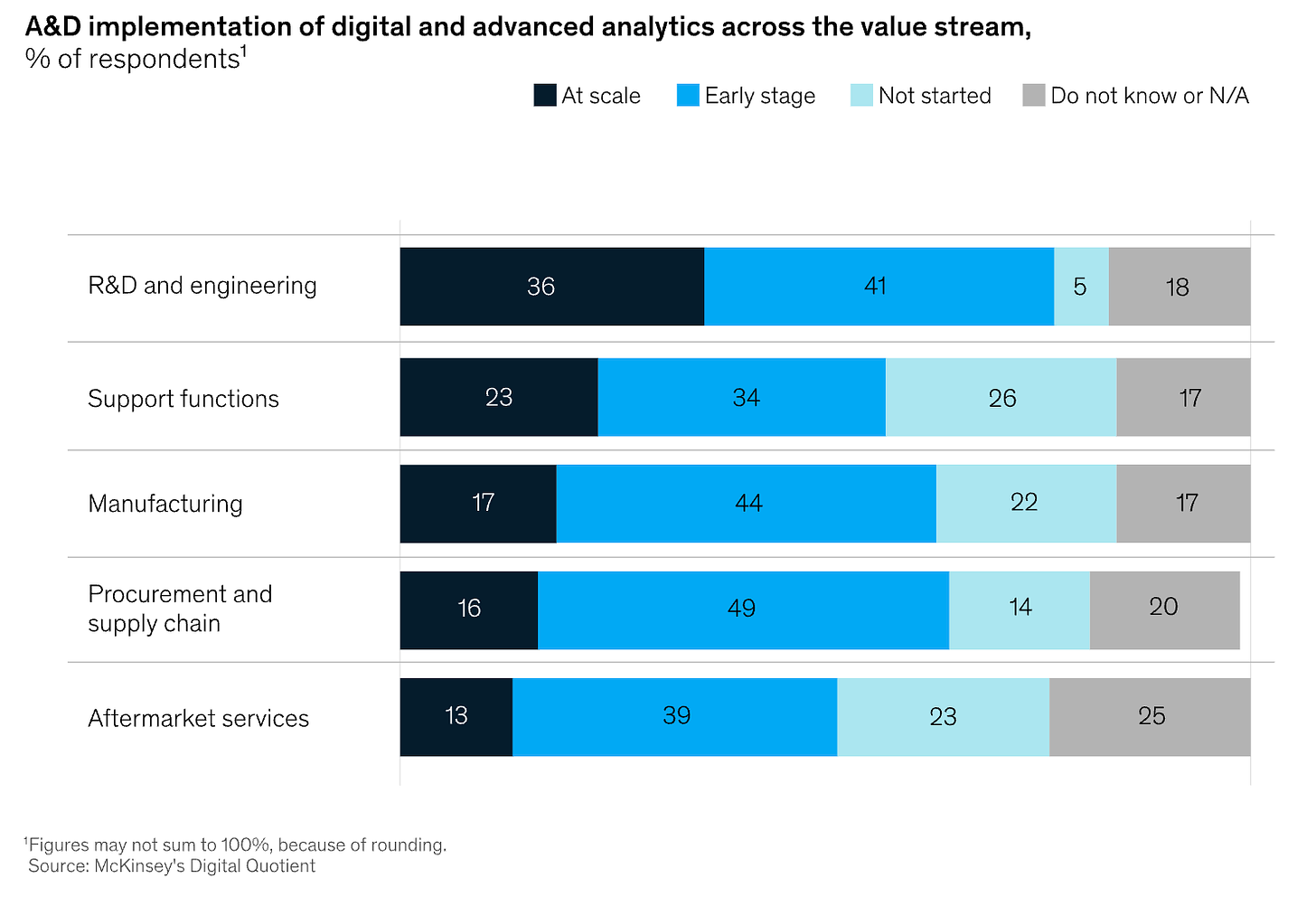

Additionally, as computing and analytics technology has improved over the past few decades, US manufacturing has the opportunity to continue to improve the performance of robotics and automation already present in our factories. According to a McKinsey report, manufacturing analytics tools have remarkably low market penetration – in 2021, only 17% of aerospace and defense companies used digital analytics at scale in their manufacturing processes. Companies like Fero Labs, Traction, Seeq, Matta, and Parsable have the opportunity to provide manufacturers with factory analytics to improve factories’ efficiency and performance.

Another way to improve the efficiency of American manufacturing is to improve the software tools that are used to manage supply chains, requirements, manufacturing, and procurement pipelines. A key part of manufacturing hardware is managing supply chains, parts procurement, and vendor relationships. Today, organizations largely rely on a mix of traditional spreadsheets and legacy enterprise resource planning (ERP), requirements management, supply chain management, and business planning software like SAP, Oracle’s Netsuite, IBM DOORs, and Anaplan. Digital tool adoption is particularly low for procurement and supply chain – in 2021, only 16% of aerospace and defense companies used digital tools and analytics for procurement and supply chain management.

Legacy software tools are tremendously powerful and include features like product lifecycle management (PLM), manufacturing execution systems (MES), inventory management, customer relationship management (CRM), laboratory information management system (LIMS), electronic lab notebooks (ELN), project management, requirements management, invoicing and purchase orders, and vendor management. However, legacy systems tend to be expensive, difficult to set up (often requiring teams of consultants), and clunky to use. Additionally, because of the plethora of different systems, organizations can find it difficult to integrate their ERPs with their vendors’ ERPs (and even with the ERPs used by different units of the same company!). As a result, the information in an ERP is often not real time, and procurement / supply chain managers still need to spend hours a day communicating with vendors via traditional methods like email.

There is potential to make ERP software more customizable and user friendly for non-technical users. Some companies (most notably SpaceX and Tesla) have even built their own internal ERPs, procurement management, and supply chain management tools, showing there is market demand for more customized ERP and supply chain / procurement management software. The success of companies like Salesforce, ServiceNow, and Monday.com show the power of highly customizable software that enables people who are not software engineers to develop automated workflows based on their customized data. Today’s ERPs generally require teams of consultants and software engineers to customize them. However, some next-gen ERPs will enable non-technical users to customize their workflows through low code / no code interfaces.

Supply chain management, requirements management, and procurement management all represent an exciting opportunity for disruption by generative AI. Companies like Stell, Altana, Redshift, Diagon, and many others (including some very early stage startups still in stealth) have emerged to develop more user friendly, collaborative, and customizable ERP, requirements management, project management, procurement management, and supply chain management software.

Supply chain, requirements, and procurement management all rely on unstructured, natural language communication by way of email, WhatsApp, phone calls, and PDFs. Similarly much of the information regarding supply chains (like information about materials and components) resides in unstructured, non-standardized, natural language documents (trade regulations documents, RFPs, datasheets, product spec PDFs, etc).

Workflows that are highly reliant on unstructured, natural language, non-standardized information are ripe for improvement from advances in generative AI. Over the past year, I’ve seen a handful of early stage companies pop up to explore how generative AI can help make managing supply chains, requirements, and procurement more efficient and effective. Generative AI can extract relevant information from natural language emails and PDFs and could automate some forms of communication between buyers and suppliers (for example by drafting and potentially sending emails for simple / routine questions). It can also process large amounts of information related to supply chains to help organizations ensure their supply chains are free of forced labor, are compliant with trade laws, and do not touch adversary entities.

In the past, many companies have struggled to roll out supply chain / procurement AI and analytics software because their supply chain and procurement data is not well organized or clean. Generative AI can help organizations clean and organize their data for use by traditional AI and analytics software. Furthermore, generative AI may also be used to help organizations better integrate disparate ERP systems to better receive real time information from stakeholders within and outside of their organization. I’m not saying generative AI will be a silver bullet to fix all hardware engineers’, supply chain managers’, and manufacturers’ procurement, requirements management, and supply chain management woes, but effective use of generative AI will enhance the next generation of software tools used by organizations that develop and manufacture hardware.

Finally, some startups are re-imaging our manufacturing processes themselves. Of course, there are a whole host of companies selling 3D printing technologies that enable fast SLA prototyping. Furthermore, metal 3D printing (especially selective laser melting technology) has enabled companies like SpaceX and Relativity Space to entirely print complex aerospace parts like rocket engines. Companies like Rangeview are re-imagining foundries by 3D printing ceramic molds for investment casted metal parts, enabling their customers to create parts they’d never created before. Meanwhile, Hadrian and Daedalus are re-imagining machine shops by automating the process of manufacturing precision metal components. Companies like Rangeview, Hadrian, and Daedalus are working to improve the efficiency of the US manufacturing supply chain by reducing the lead time on custom components that, today, can be costly and timely to produce.

Bringing new technology to the manufacturing sector will not be easy – legacy software is deeply entrenched in existing workflows, buyers tend to be risk averse, many end users are small businesses that lack large budgets and digitally-savvy employees, many organizations do not have clean data that can easily be ingested AI and analytics software, and sales cycles in the manufacturing industry are long. However, if we wish to live in a country in which companies like Neros, Apex Space, and even large defense primes like Lockheed Martin (even multi-trillion dollar programs like Lockheed Martin’s F-35 are infamously behind schedule, over budget, and have trouble managing their own supply chains, and so could benefit from new technology to improve resiliency and efficiency) can effectively manufacture systems critical to US national security in the US and allied countries, we will need to continue to improve the technologies used in our manufacturing base.

As always, please reach out if you or anyone you know is building at the intersection of national security, manufacturing, and commercial technologies. And please let me know your thoughts! I know this is a quickly changing technology space and welcome any and all feedback. Where else are there opportunities for technology to change the way we manufacture and monitor our supply chains?

For an excellent overview of US Supply Chain Vulnerabilities, particularly as they relate to China and Russia, see the “US Supply Chain Vulnerabilities” report released by the US-China Economic Security Review Commision.

For an excellent overview of the history of Taiwan’s semiconductor industry, see Chris Miller’s book Chip War.

Note: The opinions and views expressed in this article are solely my own and do not reflect the views, policies, or position of my employer or any other organization or individual with which I am affiliated.

Excellently researched article… nicely done!